In Borger, TX, car title loans lenders prefer vehicles with low to moderate mileage (under 100k) for better condition and value assessment, impacting loan approval criteria. High-mileage cars may face stricter terms. Lower mileage enhances borrowing options, facilitates debt consolidation with favorable interest rates, and demonstrates vehicle reliability during the loan transfer process for Car title loans Borger TX.

In the competitive world of Borger, TX, car title loans offer a unique financial solution. Understanding how mileage affects these loans is crucial for prospective borrowers. This article delves into the specific requirements and implications of high mileage on loan approval in Borger. We explore the benefits and considerations of car title loans with higher mileage, providing insights to help you make informed decisions in today’s digital era.

- Understanding Mileage Requirements for Car Title Loans Borger TX

- How Does High Mileage Impact Loan Approval in Borger?

- Benefits and Considerations of Car Title Loans with Higher Mileage

Understanding Mileage Requirements for Car Title Loans Borger TX

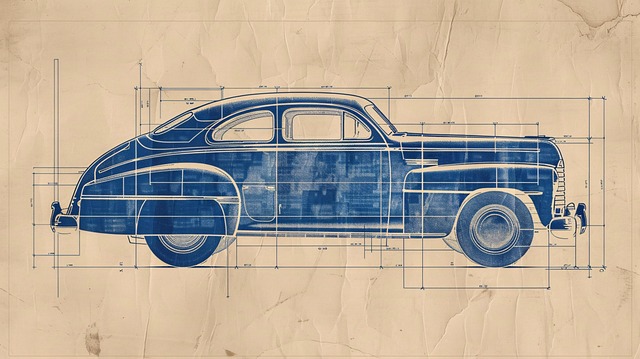

When considering a Car Title Loan in Borger TX, understanding the mileage requirements is a crucial step in the title loan process. Lenders often have specific guidelines regarding the vehicle’s mileage to ensure its value and condition. For Borger TX car title loans, lenders typically accept vehicles with low to moderate mileage, usually under 100,000 miles. This is because cars with higher mileage may be more prone to mechanical issues or accidents, impacting their overall value during the vehicle valuation process.

The title loan process involves a thorough assessment of your vehicle’s condition, and mileage plays a significant role in this evaluation. Lenders will appraise your car based on its make, model, year, and current state, taking into account factors like exterior and interior damage, wear and tear, and the overall market demand for such vehicles. As an emergency funding solution, car title loans can be attractive for Borger residents who need quick access to cash, but ensuring your vehicle meets the mileage criteria is essential to secure a favorable loan agreement.

How Does High Mileage Impact Loan Approval in Borger?

In Borger TX, car title loans are a popular option for those seeking quick financial assistance. However, one factor that significantly impacts loan approval is vehicle mileage. Lenders typically prefer lower mileage vehicles because they generally indicate better overall condition and longer life expectancy. This perception influences the assessment of a borrower’s risk profile and can affect the terms of the loan, including interest rates and repayment periods.

High mileage on a car may result in more stringent lending criteria for car title loans Borger TX. Lenders might view higher mileage as an indicator of increased wear and tear, which could lead to potential mechanical issues or reduced resale value. Consequently, borrowers with high-mileage vehicles may face challenges in securing favorable loan terms. Alternatively, opting for a vehicle with lower mileage can enhance borrowing options, making it easier to access emergency funds through a title pawn when needed.

Benefits and Considerations of Car Title Loans with Higher Mileage

When it comes to Car Title Loans Borger TX, higher mileage can present both benefits and considerations for borrowers. One advantage is that vehicles with more miles on them often have lower resale value, making it easier for lenders to assess and secure a loan against the vehicle’s equity. This can result in better interest rates and more favorable terms for applicants.

Additionally, these loans can be particularly useful for those seeking Debt Consolidation. Higher mileage might indicate that the vehicle is a reliable mode of transportation, which is essential when considering a loan. During the Title Transfer process, borrowers should keep in mind that lenders will thoroughly evaluate the vehicle’s condition and mileage to determine its value accurately. This ensures a fair agreement and can be beneficial for borrowers looking to consolidate multiple debts into one manageable car title loan.

In conclusion, understanding how mileage affects car title loans Borger TX is crucial for borrowers. High mileage can both challenge and benefit loan approval processes. While it may limit traditional lending options, car title loans with higher mileage offer an alternative solution with flexible terms. Borrowers should carefully consider their financial needs and the benefits of this type of loan to make informed decisions regarding their vehicle’s value in Borger, TX.