Car title loans Borger TX offer swift financial aid with lower interest rates, using your vehicle's title as collateral. Process is simple, providing lump sum repayment over a set period. Home Equity Loans provide access to funds via home equity but are stricter and time-consuming. Car title loans have quicker funding and flexible payments but higher risk; home equity loans offer lower rates but potential foreclosure risk if defaulted.

In the financial landscape of Borger, Texas, understanding your loan options is crucial. This article delves into two prominent alternatives: car title loans Borger TX and home equity loans. By exploring their unique features, we aim to guide folks navigating these financial decisions. We’ll uncover key differences, highlight pros and cons, ensuring readers make informed choices tailored to their needs. Whether considering a car title loan or home equity option, this comparison promises insights for the savvy borrower.

- Understanding Car Title Loans Borger TX

- Home Equity Loan: Alternative Options

- Key Differences and Pros & Cons

Understanding Car Title Loans Borger TX

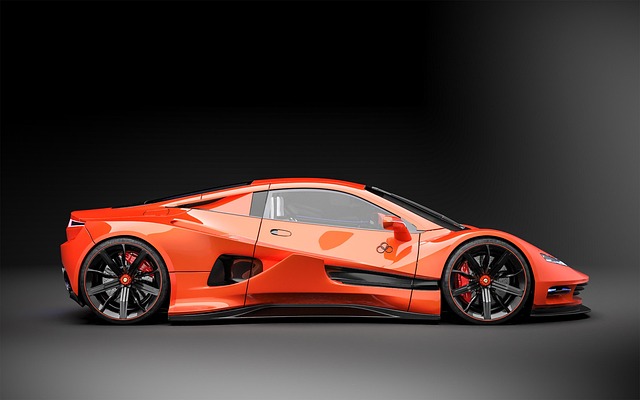

Car title loans Borger TX have gained popularity as a quick and accessible form of financing for individuals in need of cash. This type of loan uses your vehicle, specifically its title, as collateral, allowing lenders to offer lower interest rates compared to traditional personal loans or credit cards. The process involves a simple application, where you provide proof of ownership and vehicle inspection to assess its value. Once approved, you’ll receive a lump sum, and the loan is typically repaid in monthly installments over a set period.

Unlike Houston title loans, which may have more stringent requirements and longer waiting times, Borger car title loans offer speed and convenience. Borrowers can choose from various repayment options tailored to their financial comfort, making it an attractive choice for those facing unexpected expenses or looking for a short-term solution until their next payday. This alternative financing method provides flexibility while ensuring that the lender has security through the vehicle’s title.

Home Equity Loan: Alternative Options

When considering short-term financial options, a Home Equity Loan stands as an alternative to traditional car title loans Borger TX. This type of loan leverages the equity in your home, allowing homeowners to access a line of credit or a lump sum based on their property’s value. It’s particularly appealing for those who need quick cash for unexpected expenses, such as medical emergencies or home repairs, as it often offers lower interest rates compared to other types of loans, including Bad Credit Loans.

However, the process of securing a Home Equity Loan may be more complex than online applications for Car Title Loans Borger TX, with stricter requirements and a longer approval time. Unlike some car title loan options that are readily available, these loans require significant collateral, which can be a deterrent for those seeking emergency funds without selling their asset. Nonetheless, it’s an option to consider when evaluating your financial needs and the value of your home.

Key Differences and Pros & Cons

When comparing Car Title Loans Borger TX to Home Equity Loans, understanding key differences is essential for making an informed decision. One significant distinction lies in the collateral requirement. Car title loans require ownership of a vehicle as collateral, while home equity loans use your home’s equity. This means car title loans offer quicker funding, as the approval process is often faster due to less stringent requirements and less paperwork compared to home equity loans.

On the pros side, car title loans provide quick funding, making them ideal for immediate financial needs. Additionally, with flexible payments, borrowers can tailor their repayment plans based on personal circumstances. However, cons include higher interest rates than traditional loans and the risk of losing your vehicle if you fail to repay. Home equity loans, while securing against property, may offer lower interest rates but could pose a significant financial risk if you default, potentially leading to foreclosure.

When considering short-term financial solutions in Borger, TX, car title loans offer a unique advantage compared to traditional home equity loans. While both provide access to immediate cash, car title loans have fewer stringent requirements and faster approval times, making them ideal for those with less-than-perfect credit or urgent needs. However, it’s crucial to weigh the benefits and drawbacks of each option carefully before committing. In the case of Borger residents, car title loans present a convenient and accessible choice within the local market.